The new consumer marketing

How a new generation of direct-to-consumer brands is reimagining relationship management and transforming the marketing world.

For a breakdown of the difference between Customer Data Platforms (CDPs) and Customer Relationship Management (CRM) tools, see this post.

As the Chairman of Procter & Gamble put it back in 1977, “Only when satisfied customers have had firsthand experience with the product will the elements of the marketing mix, such as advertising and selling, be fully productive.”

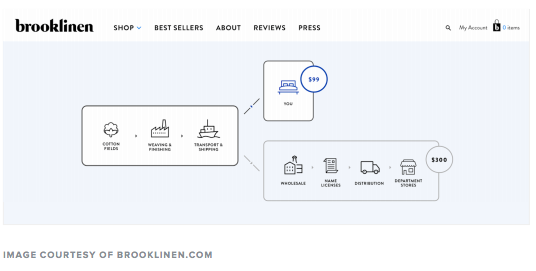

This much hasn’t changed. What has changed is pretty much everything else. Across every consumer category, the path to purchase has become multi-threaded, involving smartphones, voice assistants, and connected TVs, among other channels. Each touchpoint leaves a trail of data that, when properly leveraged, can be used to improve future interactions. At the same time, supply chains have become “rentable, flexible, and affordable,” providing brands with unprecedented access to their consumers, without middlemen.

Together, these changes have given rise to a new breed of Direct-to-Consumer (DTC) brands, distinguished by their ability to superserve existing customers. By taking advantage of new data streams, these firms have built personalized customer relationship strategies that are responsive to every consumer interaction—regardless of where it occurs. And with their newly flexible supply chains, DTC brands are even using customer data to change how they deliver products and services.

These next-generation organizations don’t just represent the latest evolution of customer relationship management (CRM), they’re changing the face of consumer marketing itself.

What is a DTC brand?

When the Interactive Advertising Bureau (IAB) and Dun & Bradstreet published their top 250 DTC brands earlier this year, it was no surprise that ecommerce brands like Glossier, Warby Parker, and Jet.com made up a large portion of the list. But while it’s true that many DTC brands come from ecommerce roots, the distinction between “direct” and “indirect” is more nuanced than just “physical” versus “digital”.

In fact, DTC brands like Allbirds, Casper, and Amazon are investing in physical presences, just as historically indirect firms like Adidas and Unilever are growing their DTC offerings. The key difference is that direct brands know who their consumers are individually, and they apply this knowledge to build enduring, ongoing customer relationships.

Indeed, while relationship marketing has been around for some time, DTC brands are applying it in new ways, creating sophisticated, precision marketing at a scale the world has never seen before.

Different folks, different spokes

What makes this new customer relationship management (CRM) different is that it’s being executed by new kinds people, who bring different skills, goals, and technological frames to the table.

Traditionally, CRM was practiced by B2B marketers and a small subset of B2C brands (catalog retailers, loyalty programs, and the like). Now it’s everyone, from consumer packaged goods (CPGs), to post-cable networks, to coffee chains. This new CRM is built on the basic premises of traditional CRM, but it has modernized its principles to such a degree as to transform them beyond recognition.

One of the primary reasons why so many legacy CRM programs failed was that they didn’t set their sights high enough. They were optimizing for productivity metrics, not strategic ones, and largely put under the auspices of an IT project. When the going got tough, which it inevitably does for something as complex as CRM, companies couldn’t muster the C-Suite commitment to continue investing.

While the complexity has not gone away, the new CRM is owned and led by front-line business groups -- typically marketing -- and thus focused squarely on growth-oriented objectives like revenue and customer experience. Its leaders are using customer relationships to drive metrics such as the following:

- Marketing - New customer acquisition, customer engagement & retention

- Sales - Revenue growth, cross-sell/upsell

- Customer Experience - Customer lifetime value, net promoter score

In DTC companies at least, the leaders of the new CRM have the organizational clout to commit the resources necessary, and rally the stakeholders needed across the organization, to achieve their objectives.

For example, when the marketing team at Gilt wanted to measure the lifetime value of its different acquisition channels, they collected and connected data from not only marketing, but also commerce, customer support, and content systems. Gilt’s goals could not have been met had the marketing team been unable to access company-wide data, or do so only via weak and brittle integration methods.

How to succeed at the new CRM

OPEN & EXTENSIBLE

The old CRM was typically built upon monolithic vendor implementations, with inflexible data models. You couldn’t import whatever data you wanted into them, and you certainly couldn’t get data out beyond their walls. By contrast, the architectures that support the new CRM are open and extensible.

When Overstock went in search of new CRM partners, it opted for a modern customer data platform (CDP) with a flexible data model and hundreds of productized vendor integrations. Taking what Gartner has described as a “Smart Hub, Dumb Spoke” approach, Overstock now uses best-in-breed vendors for everything from machine learning, to messaging, to personalization. The result is a system that allows Overstock to create and iterate from a single, one-to-one engagement platform.

MULTI-THREADED IDENTITY

The old CRM assumed a single customer identifier, rendering brands incapable of handling customer journeys across multiple channels. The new CRM takes complex, multi-device journeys as a given.

For example, when Jet.com set out to understand its customers, it started by creating a single view of the customer record across its web and mobile app platforms. Since being acquired by Walmart, the brand has begun integrating this view with other records and systems.

DATA-IN-MOTION

The old CRM managed customer data at rest, focusing on relationship history data points like phone calls, meetings, and past purchases. Managing real-time was not a priority -- nor was it even technically feasible until only a few years ago.

The new CRM uses advancement in real-time data to serve relevant offers in the moment. The Chick-fil-A mobile app, for example, uses location data and push notifications to predict when it should submit orders to the kitchen. The ridesharing company Via uses its app data to optimize vehicle distribution and minimize rider wait time. In addition to triggering faster marketing messages, data-in-motion is a powerful weapon for exceeding consumer expectations.

MEDIA-CRM

The old CRM helped companies engage customers through email, call centers and direct mail, but advertising (paid media) was not widely a factor. The new CRM connects to advertising technology and people-based marketing platforms, ranging from Facebook and Snapchat to a host of data management platforms (DMPs) and demand-side platforms (DSPs).

For example, the sneaker marketplace GOAT uses its segmentation to target new customers through owned and paid channels, guiding them towards purchase within the first 30 days of app interaction. This past holiday season alone, GOAT’s strategy of targeting lapsed users via Facebook resulted in millions of dollars in incremental sales. That’s a lot of sneakers!

PRIVACY BY DESIGN

Because the old CRM was limited in its ability to identify individual customers and their journeys, privacy was not a central design consideration. But as companies implement sophisticated systems that track personally identifiable information (PII) and real-time location data, privacy has become a critical concern for consumers and legislators, alike.

The new CRM is built with privacy at its core. This allows brands to personalize their customer interactions while simultaneously respecting the consumer’s rights when it comes to how their data is collected, used, and shared. The new CRM -- when done correctly -- is part of the solution, not the problem, for regulations like the EU’s GDPR.

The identity revolution has come to consumer marketing. Are you ready?

The rise of DTC brands is evidence of a larger trend -- the rise of the new CRM. While marketers where once content to advertise to broad swaths of consumers, today’s fastest growing brands are focused on marketing to people whose identities are known.

To say that this shift has already had a profound impact on the marketing landscape would be something of an understatement. Due to the power of the personalized CRM, DTC companies now exist in every consumer category, and the IAB’s research suggests that almost all the growth in consumer brands is being driven by these new business models. As Randall Rothenberg, Chairman of the IAB stated, successful DTC brands are no longer an oddity, but are instead representative of an “enduring shift in the way the consumer economy operates,” to the point that they’re now supplanting the indirect brands that dominated the U.S. economy for nearly 140 years.

In the years to come, consumers will increasingly expect every company they patronize to deliver the personalized, seamless experiences they receive from their favorite DTC brands. It’s a tall order to meet these expectations while also maintaining customer data privacy standards, but that is exactly what every brand now must do.