Power your mobile financial services strategy

With the rise of mobile financial services, traditional financial companies have to change the way they approach modern customers or face failure.

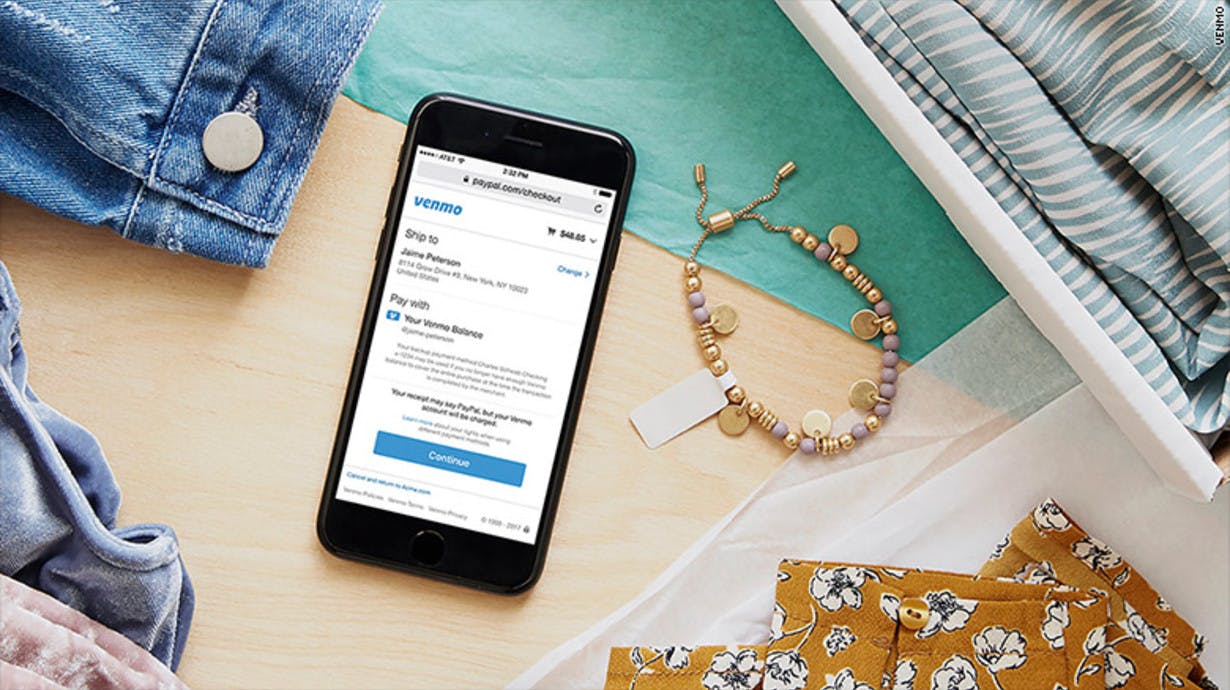

If you were to ask someone to name the first financial service provider (FinServ) they could think of, you’ll receive a variety of companies depending on a person’s age, career, or even mobile-competency. You may hear “Venmo” or “PayPal,” if you ask a millennial, while you’re more likely to hear “Visa” or “Bank of America” from a member of Gen X. The challenge for traditional FinServ providers is to bridge that generation gap and create a strong user base in a market that is not only highly competitive but also in major flux.

As mobile has come to play a bigger part in how people pay personal and business debts, traditional FinServ companies, like most major banks, have had to change the way they approach modern customers or face failure. In this blog, we will cover the challenges posed to FinServ brands by the fundamental changes in consumer expectations, digital, and security and what they need to do to deliver a successful mobile financial services program.

Consumer expectations

Before the mobile revolution consumers handled finances significantly differently from today; for most of its existence, FinServ has relied on physical methods to help consumers access and manage their finances: writing checks, cashing checks at local branches, withdrawing cash from ATMs, and even using a physical credit card to pay at a store register. Now, we snap, tap, and scroll on our mobile device of choice to accomplish these once-tedious tasks. With the advancement of mobile services, consumers no longer view FinServ tasks as errands. With this change, consumer expectations have also changed—consumers expect to use their mobile devices to get what they want when they want, and for it to be secure and work perfectly every time.

Accommodating these expectations in this new paradigm presents great challenges for traditional businesses. As software-first institutions continue to disrupt how consumers use and perceive FinServ companies, traditional businesses have to develop new strategies and technologies to keep up. This isn’t easily done because FinServ companies, which haven’t had these features or products in place since the beginning, have long, rigid processes for introducing new concepts in an effort to ensure data security. But, mobile financial services is just the beginning. With the advancement of technology like blockchain, even my prior examples of how we traditionally interact with our service providers are becoming outdated.

So, this then begs the question: How do we meet both the existing and future needs of our customers? The answer lies in creating a technology stack that allows you to not only understand who your customers are but also what changes need to be made in your product to meet their expectations. In industries like FinServ, where agility is critical, but difficult to achieve, a secure foundation for customer data collection, experimentations, and deployment can make all the difference when it comes to user experience and retention.

Venmo faced similar challenges to other FinServ companies: they had users, and had data on them, but didn’t have a process for leveraging this data across their suite of internal and third-party tools to ultimately improve their product and users’ experience. To address these challenges, Venmo used mParticle to centralize data, automate connections, and create data transparency across the organization—all of which lead to improved app performance to the tune of a 30% increase in engagement.

Digital

Early on it was common practice for Financial Service providers to rely on what are now severely dated Data Platforms. In the ‘90s, and earlier, they relied on offline databases comprised of a low volume of data that was structured in rows and columns. It was all stored offline, infrequently accessed, and not strategically used. Then, in the early aughts, came the Web Era. DMPs were the best that technology had to offer—they were scalable and stored detailed lists of web behaviors. That’s all well and good but the kicker is that we’re now beyond the Web Era.

As of the early 2010’s, we’ve entered what’s known as the Connected Era. This era is characterized by the many different ways that customers now interact with brands across channels, devices, and platforms. Offline and disconnected databases are out of the question even for the most legacy businesses. DMPs, while having the previously mentioned benefits, also have numerous limitations when it comes to mobile and web data collection. They maintain a collection of browser cookies that generally lead to anonymity, store data in a string of attributes, and work primarily with web data. Besides being unable to collect data at the granularity brands need today, the data DMPs can collect is often siloed and stored with less-than-optimal security and governance standards. “According to a recent survey of financial industry executives, it seems clear that cooperation between departments—or lack thereof—is often the source of many headaches,” states John Choi, the Director of Operations at Liferay. In fact, some estimates indicate that businesses use only .5% of the data that’s available to them*. If you’re not already analyzing your current offerings, comparing them to what you plan to offer, and evaluating how to make it feasible, you’re behind.

The first step in preparing for the present and the future is to ensure that your aspirations are, in fact, feasible with how you operate as a business today. Justin Paterno, the COO of StockTwits, a virtual trading floor for investors and traders, was able to identify several challenges while doing a similar evaluation. StockTwits understands the value in having real-time and connected data across all their third-party tools and partnered with mParticle to get there. This not only alleviated SDK bloat but allowed them to orchestrate their data across all of these tools without tying up precious engineering resources.

Security

Data security isn’t a new practice, and neither are governmental regulations. What is changing is the stringency of new requirements and the frequency at which they’re being proposed. As recently as September 2016, Andrew Cuomo, the Governor of New York, announced a proposal explicitly for financial institutions requiring them to establish a cybersecurity program designed to ensure the confidentiality, integrity, and availability of information systems. Particularly notable, amongst other regulations, is GDPR, which is going into effect on May 25th, 2018. Forrester Predicts that 80% of companies will fail to comply with GDPR. This is significant, considering the fact that non-compliance merits a fine worth up to 20 Million Euros, or 4% of global revenue, per instance. While the threat of data breaches are incentive enough for companies to put security measures in place, regulations with heavy consequences for non-compliance certainly add to the urgency. Fraud incidents, both online and offline, increased by more than 130% during the past year, resulting in significant monetary and repetitional losses for financial institutions.

Security is an ongoing practice that needs to be seen as an important part of how you operate as a business.The risk of security threats and breaches is ever-evolving, and so should your approach to extinguishing them. With target-rich, valuable, and indispensable customer data spread across your entire infrastructure, managing all of the entities in which data is collected, transferred, and stored independently soon becomes a job on its own—frequently requiring a dedicated team.

What can you do?

mParticle offers a single, secure API for you to integrate all of your digital properties with third-party tools and orchestrate user data across your technology stack. All data, in transit and at rest, is encrypted and accessible with enterprise-grade protocols. mParticle also offers live monitoring and filters so you’re always aware of what data is being sent where and control access granular level. This allows governance controls on where to consolidate or segregate customer data. With mParticle, you not only have access to in-depth customer data mapped to individual consumers for better personalization than ever across all devices and channels, you also have the peace of mind that this personally identifiable data (PII) is stored and managed securely. The next time you ask someone to name the first FinServ company that comes to mind, make sure it’s yours.

If you’d like to learn more about how leading financial brands are leveraging mParticle to simplify their data pipeline, you can try our platform demo here.

*Salazar-Mangrum, Chris, “Building Business Intelligence,” Security Dealer, October 1, 2017, accessed on www.pwc.com on February 22, 2018